Ebook : Day Trading For 50 Years The Michael S. Jenkins Methods

Preface

Day Trading is the very hardest investment activity in the world. I would venture a bet that if you took the best mutual fund managers and hedge fund managers in the world and forced them to trade every day for a living and live solely off their capital gains, the vast majority would be bankrupt in one to three months. You see long term investing or even swing trading for six weeks or so allows for quite a bit of slippage and losses of all the time that are not realized but carried forward to be sold on some future date when they regain profitability. Holding portfolios for a year like most institutions do, limit your gains to market rates like 20% at best per year (or losses of 20% too) whereas the very best day traders can make 50%, 100% to even over a thousand per cent on their capital every single year. Many lose all their capital in a few months and give up. But the exceptional ones can go for decades compounding their money often at over 100% a year for a decade or longer. A strict Day Trader’ buys and sells every day and is ‘flat’ with no positions at the end of the day. In some cases you can carry positions overnight but not for several days usually. You see, the day trader uses borrowed money on margin at 4 to 1 on his capital or at some firms 10 to 1 or even more. If you have a $25,000 small account and you are trading $250,000 worth of stock, any sudden normal 1% drop in the market will result in a $2,500 loss or 10% of your capital. It doesn’t take many bad trades to lose all your capital. Because of the high leverage, day traders can make a lot on their capital or lose it all very quickly. They manage risk by having very small TIME exposure to the market with large CAPITAL exposure. Usually they jump in quickly at the start of the day and buy something moving and scalp a quick profit in 15 minutes and are out. To do this economically you usually need to trade in units of 1000 shares of stock so a 30 cent gain is $300 or a $1.25 dollar gain is $1,250. Larger more experienced day traders with lines of credit of $1 million or more will frequently have positions of 3,000, 5,000 or 10,000 shares of individual stocks and perhaps 20-30 different stocks during the day. It is A LOT of work buying quickly and selling up 25 cents or half a dollar and doing that perhaps dozens of times each day. You are not trying to make a killing’ on any one trade but just a lot of consistently profitable trades of small amounts that with the leverage you are using adds up to significant gains on your capital. Remember, you can’t lug around positions that aren’t moving since you must pay all your bills weekly to monthly to live and you don’t get a ‘draw’ salary like at a hedge fund and hope stocks go up over time. You have to put money in the bank every week.

Many people think that day trading is gambling but if you go to Las Vegas and play the slot machines they usually ‘pay out’ 96 coins for every 100 coins put in. This seems fair since for the 100 pulls on a $1 slot machine you get 100 chances to win a huge jackpot. What they don’t realize is that you can pull that level 100 times in only 60 seconds to two minutes and rather than walk away you scoop up the 96 coins and do it again and this time only get 92 coins back. If you do this for a half hour or more you will lose all your money. This is gambling since the house has a built in percentage edge that over time will always take your money. Stock trading is not gambling but speculation. The difference is that YOU get to pick the odds of a good trade, YOU get to decide how much to bet, YOU get to cut your losses quickly, and YOU can let your profits ‘run’ or continue to go up as long as the market is trending in your favor. YOU can also decide to trade or not trade and just wait. In this fashion you can often get odds of 90% in being right on trend and a high probability of large gain with a variable stop loss to insure a minimum loss, or letting the profit grow to a maximum the trend will allow. Obviously if you don’t have patience and discipline, you will not make it. You must become a machine.

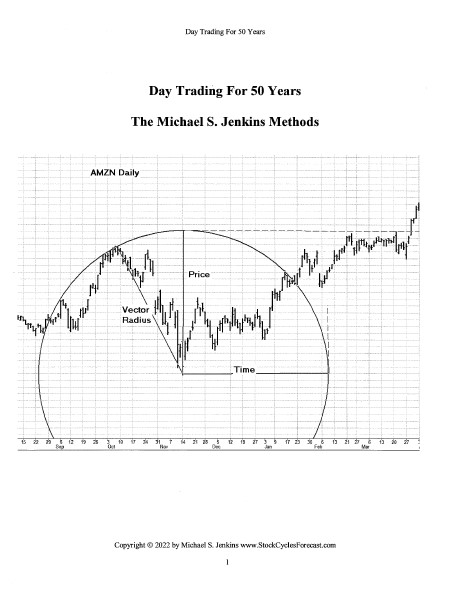

The title of this book is ‘Day Trading for 50 Years’ since I graduated from college in 1971 and started working in investments immediately. I had actually learned about the market when I was 9 years old and was really bitten by the bug having read at age 12 the greatest stock market book of all time Reminiscences of a Stock Operator- by Edwin Lefevre- the fictionalized autobiography of the great speculator Jessie Livermore. I read it every year for the next ten and recently in the year 2000 started reading it again as the 100 year cycle was repeating exactly as it happened in the early 1900’s when that book was written. I had studied business and economics in college and got a Masters in Business Administration and passed the CPA exam and was working through the CFA exams all in an effort to be the best ‘analyst’ of business reports and somehow that would lead to making money in the stock market. Nothing could be further from the truth. I soon learned that the market is EMOTIONAL and based on FEAR and GREED and has very little to do with RATIONAL earnings projections and so called ‘fundamentals’. Wall Street uses that sales pitch to get your money knowing that you are not a competent analyst and will have to rely on them. There is one and only one important thing in trading and that is PRICE. Price determines whether you win or lose and has nothing to do with how great your company is or how great the forecast of earnings appears to be. If price goes up you win and if down you lose. The ONLY way to determine that is thru technical analysis using charts and time cycles. This is what I have done for 50 years now with a great many of those 50 years working 18 hour days studying charts and past markets. You need to use your RATIONAL mind to study EMOTIONS and only place trades when emotions are at extremes. My study of geometric patterns and circular arcs describe such emotions in mathematically precise ways.

I have worked in a variety of investment firms from bank trust departments, mutual funds, stock and commodity brokerage firms, specialist upstairs trading, and proprietary professional day trading at a number of firms. I have seen all the methods, and worked with the great traders and the fake traders. This book will show what I have learned to be the key PRINCIPLES of trading and since they are principles they can be applied to any time frame, any market, and any currency, stock, commodity or crypto. Using these methods I have taught hundreds of individuals how to trade with a good dozen becoming millionaires and a few making tens of millions in only a few years. It is my belief that anybody can be taught to trade profitably, i.e. make $100,000 a year. The difference between success (making $200,000, $500,000, $1,000,000 and up per year) and failure is almost always attributable to not following rules, refusing to take a loss when first acknowledged, or compulsive gambling behaviors looking to get rich quick and not take trading as a business profession seriously. Finally, day trading is WORK. They don’t give money away. It just looks that way. You have to make every single trade as if it’s an Olympic event with one chance only to get it right. And why not? Spend an hour and quickly make $500 or $1000. That’s REAL money! Remember that. It’s your money and not the ‘houses’ money meant to be gambled back and lost. You can’t get sloppy and lazy no matter how crazy the market is and how easy it is at times to make money. Those who are disciplined and only trade when they see familiar patterns and setups usually are the ones who make all the big money. This book will teach you very reliable methods and tricks of the trade that if studied will quickly eliminate your losing habits and make you a winner.

While this is a DAY trading book, just about everything taught here can be used with longer term strategies making swing trades of weeks to months. The principles are the same, just the time frame is longer. I prefer to teach you day trading because there are no excuses. You must be profitable just about every single day. You can’t just rationalize a loss saying ‘I’ll just hold this for 3-4 days and I’m sure it will come back’. Once you go down that path you are finished as a trader. Once you really master day trading and build good habits you can then go to longer term swings but basic principles must be mastered first. When I started out I took a job that had no income, no benefits, no health insurance , nothing but a hand shake to split 50/50 after expenses. You don’t know what pressure is until you try and pay rent, food, living expenses, taxes and later have a marriage partner and children going to expensive private schools. You better make money every month of your life or you will have a mental breakdown. This is what I did for 50 years and counting and now you will see how I overcame those obstacles all by myself without help from anyone, using these self discovered methods.

Michael S. Jenkins

March 3, 2022

Reviews

There are no reviews yet.